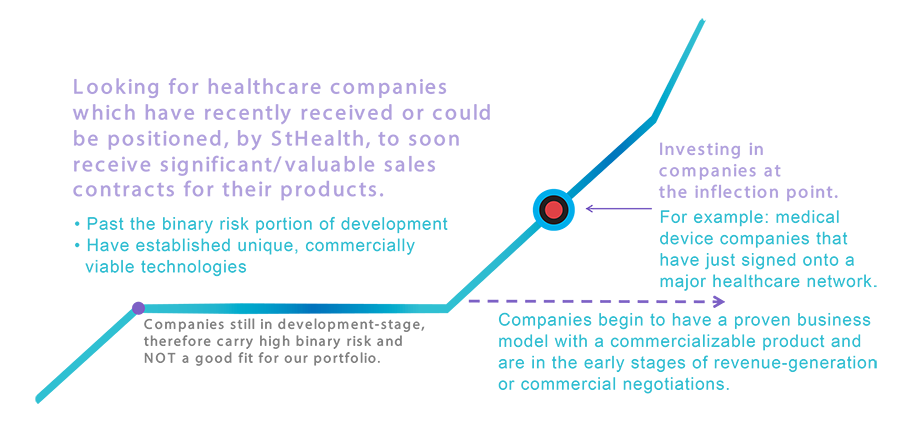

Identifying Assets for Inclusion

Finding “must-have” technologies that saves lives and money in the global healthcare system

Looking for healthcare companies which have recently received, or could be positioned by StHealth to soon receive, significant/valuable sales contracts for their products.

Maximizing Exit Opportunities

StHealth Capital invests in companies not because they may perform well on their own, but because we employ our business development and advisory skills to drive valuations to the highest possible level in preparation for an IPO/buyout to maximize shareholder returns.

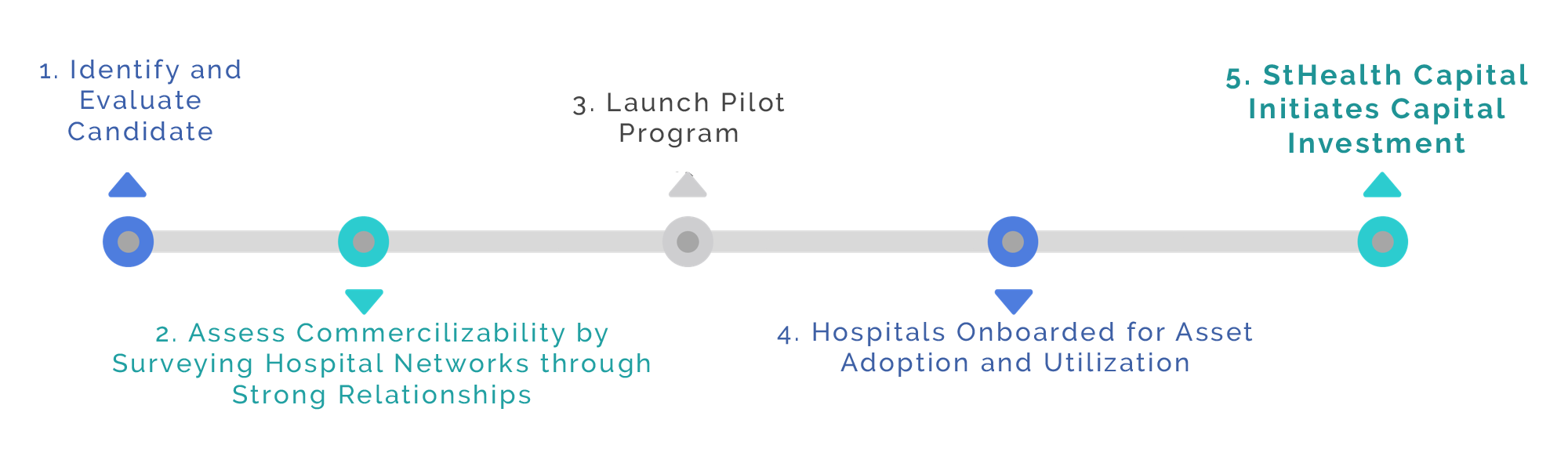

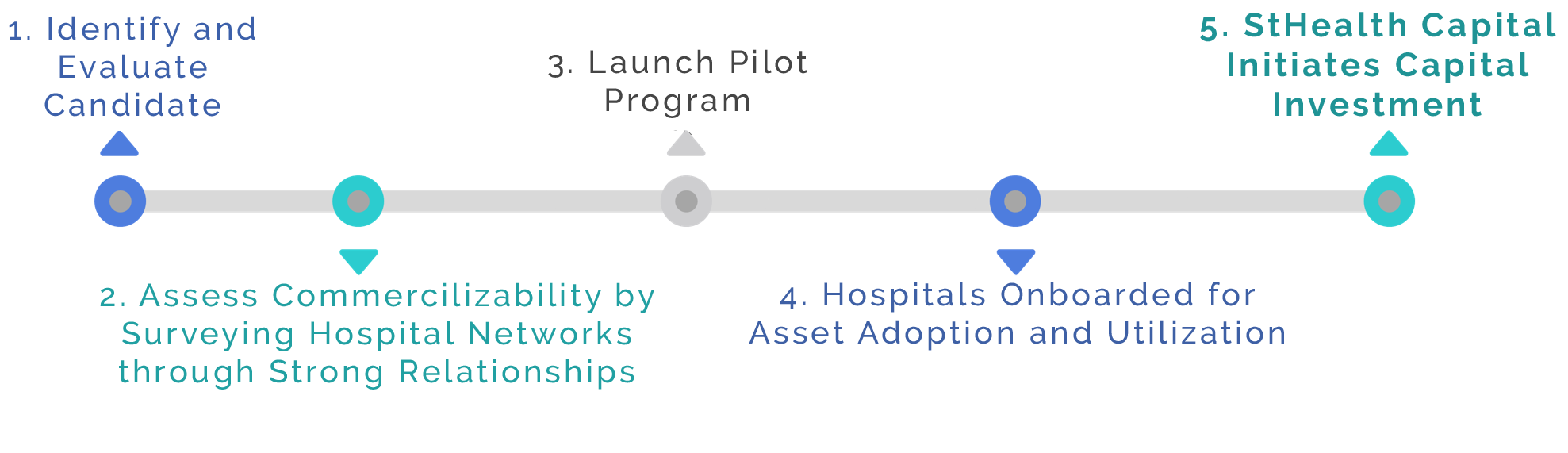

Reducing our risk with pre-investment commercial viability testing

Step-wise Value Creation Curtails Exposure to Risk

StHealth Capital chooses compelling companies for which we can drive their commercialization. The process begins with our ability, through strong relationships with significant Health Systems, to place target company products into real commercial validation settings. Only after we can measure a product’s successful traction in such a setting, will we make an investment.